Weekly DeFi Index

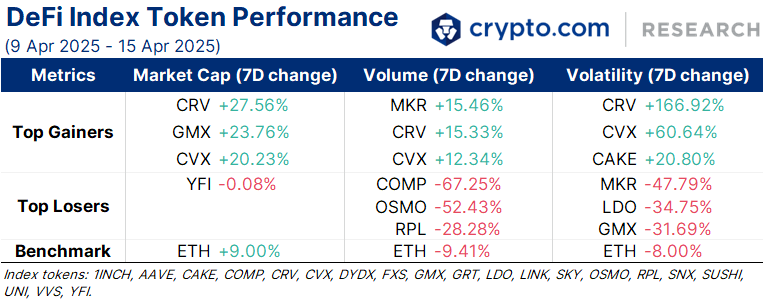

This week, the market capitalisation index increased by +7.55%, while the volume and volatility indices dropped by -14.87% and -7.84%, respectively.

- Curve Finance (CRV) reported record trading volumes of nearly US$35 billion in Q1 2025, a 13% increase compared to Q1 2024. Despite bearish sentiments in the cryptocurrency market, Curve’s transaction activity surged from 1.8 million to 5.5 million in the first quarter.

- GMX, a decentralised derivatives exchange, proposed moving the platform to the Ethereum Virtual Machine (EVM)-compatible Bitcoin Layer-2 (L2) network, Botanix. If approved, it would make GMX the first to offer trustless Bitcoin trading on an L2 solution.

Chart of the Week

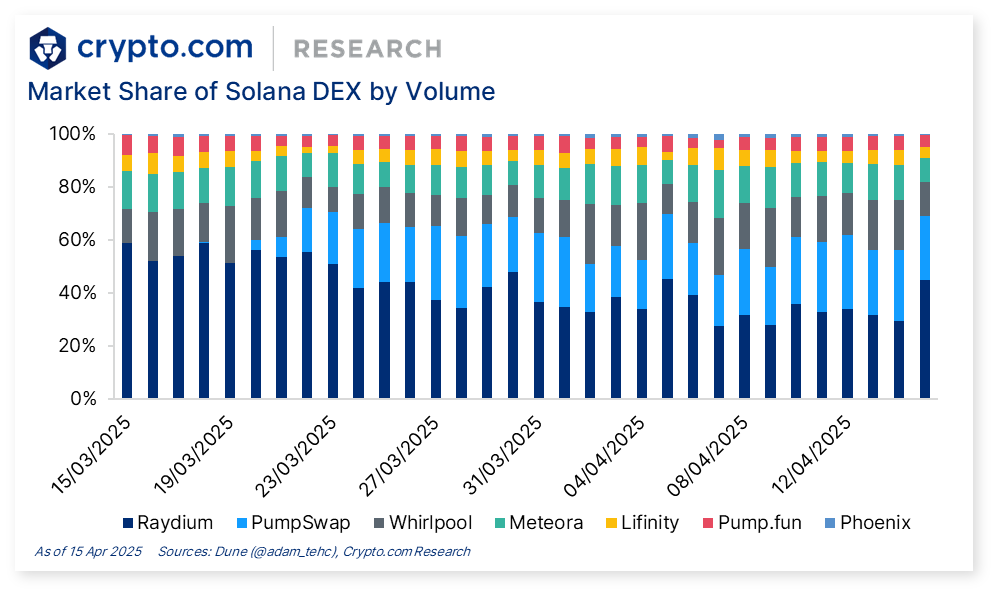

PumpSwap, a decentralised exchange (DEX) launched by pump.fun, processed $5.4 billion in trades last week, a 37% increase from the previous week. The platform’s daily trading volume peaked at $478 million with a daily active wallet count of 219,394 on 15 April.

Additionally, the combined market share of pump.fun and PumpSwap accounted for around 25% of the total Solana DEX market between 18 March and 15 April. Raydium still dominates the market with a 41% market share, but its performance has been showing a steady downtrend.

News Highlights

- The US Congress successfully reversed a rule by the Internal Revenue Service (IRS) targeting decentralised financial (DeFi) platforms, which required them to track and report user activity. This marks the first time a pro-crypto effort has cleared Congress. The resolution, signed by US President Donald Trump, prevents the agency from pursuing similar legislation in the future.

- Cronos, an EVM-compatible blockchain, and ChainGPT, an artificial intelligence (AI) AI-powered blockchain infrastructure, announced a strategic partnership to power scalable AI solutions. The collaboration enables ChainGPT to enhance its AI NFT Generator and support low-cost, scalable NFTs.

- Cosmos launched Eureka, an upgrade to its Inter-Blockchain Communication (IBC) protocol that enables native interoperability with Ethereum. This new development allows developers to build multichain apps, making it easier for users to access and interact with various blockchains.

- Centrifuge, a real-world asset (RWA) tokenisation platform, partnered with Wormhole to launch Centrifuge V3, a multichain platform for issuing and managing tokenised assets. The collaboration aims to improve the scalability and accessibility of tokenised assets across different blockchains.

- BTC staking project Babylon launched its Layer-1 (L1) blockchain, Genesis, to advance its BTC yield platform.

- Ethena partnered with restaking protocol Re to connect the crypto market to the trillion-dollar reinsurance market. This collaboration allows users to earn yield on Ethena’s USDe stablecoin or staked USDe (sUSDe) by locking it as reserve assets through Re.

- According to CoinGlass, the value of OM, the native token of the Mantra blockchain, plummeted 88.2% on 14 April and triggered over $71.8 million in liquidations. Mantra’s CEO John Mullin attributed the crash to “reckless forced closures initiated by centralised exchanges” on account holders. A plan to burn 300 million locked OM tokens worth approximately $236 million was proposed to regain the community’s trust, but reactions were mixed. Mullin also outlined plans to leverage the Mantra Ecosystem Fund for potential token buybacks and burns to stabilise OM’s price.

- Synthetix USD (sUSD) stablecoin dropped to a five-year low of $0.83 as the token struggled to maintain its USD peg. Synthetix’s founder, Kain Warwick, attributes the de-peg to the removal of the primary driver of sUSD purchases, and the transition to new mechanisms. According to Warwick, “these mechanisms are currently being transitioned, which is why the drift is occurring.”

Recent Research Reports

|  |  |

|---|---|---|

| |

|---|---|

| |

|

Wall Street On-Chain Part 2 – RWA Tokenisation: Real-world asset (RWA) tokenisation is revolutionising traditional finance by bringing liquidity, efficiency, and accessibility. This report explores tokenisation by asset classes, including institutional adoption and regional initiatives, as well as RWAs by chain.

Alpha Navigator: Quest for Alpha [March 2025]: Asset performance was mixed. Crypto and Equities led the drop, while Real Assets and Fixed Income increased. In March, US President Donald Trump signed an executive order to establish a US Strategic Bitcoin Reserve and digital asset stockpile.

The Evolution of the Institutional Crypto Market: From Liquidity to Global Adoption: This article presents the institutional crypto market, focusing on liquidity and global adoption.

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Authors

Research and Insights Team

Get the latest market, DeFi & NFT updates delivered to your inbox:

Be the first to hear about new insights:

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.